5 Largest Life Insurance Companies In U.S. Show Increase Death Payouts in 2021

Updated

By Jefferey Jaxen

In January 2022, the world was greeted to surprising information when the CEO of OneAmerica, an Indiana-based life insurance company, shared data about how the pandemic and its response by public health officials, has impacted the life and disability insurance industry.

“We’re seeing right now the highest death rates we’ve ever seen in the history of this business,” said Scott Davison, the CEO of OneAmerica, a $100 billion life insurance and retirement company headquartered in Indianapolis.

“The data is consistent across every player in the business.”

Davison said death rates among working age people – those 18 to 64-years-old – are up 40 percent in the third and fourth quarter of 2021 over pre-pandemic levels.

The fact-checkers immediately came out in force in attempts to debunk growing conversation that a newly developed mRNA vaccine technology, rushed to market with no longterm testing may have led to such an increase. AP’s fact-checking assessment placed blame on ‘the delta variant of the coronavirus and deferred medical care during the pandemic.

Despite Davison’s claim that the data is ‘consistent across every player in the business,’ no other insurance companies made it known that their 2021 data reflected this warning signal.

Then in June, Margaret Menge at the Crossroads Report posted the article titled, Fifth largest life insurance company in the US paid out 163% more for deaths of working people ages 18-64 in 2021 – Total claims/benefits up $6 billion

Annual statements filed with state insurance departments obtained in response to public records requests showed that Lincoln National insurance company saw large rises in Group Death Benefits.

Here are the precise numbers for Group Death Benefits taken from Lincoln National’s annual statements for the three years as shown at the Crossroads report:

- 2019: $500,888,808

- 2020: $547,940,260

- 2021: $1,445,350,949

By taking similar legal action, attorneys for the Informed Consent Action Network have now obtained the annual statements from the five largest insurance companies in the U.S.

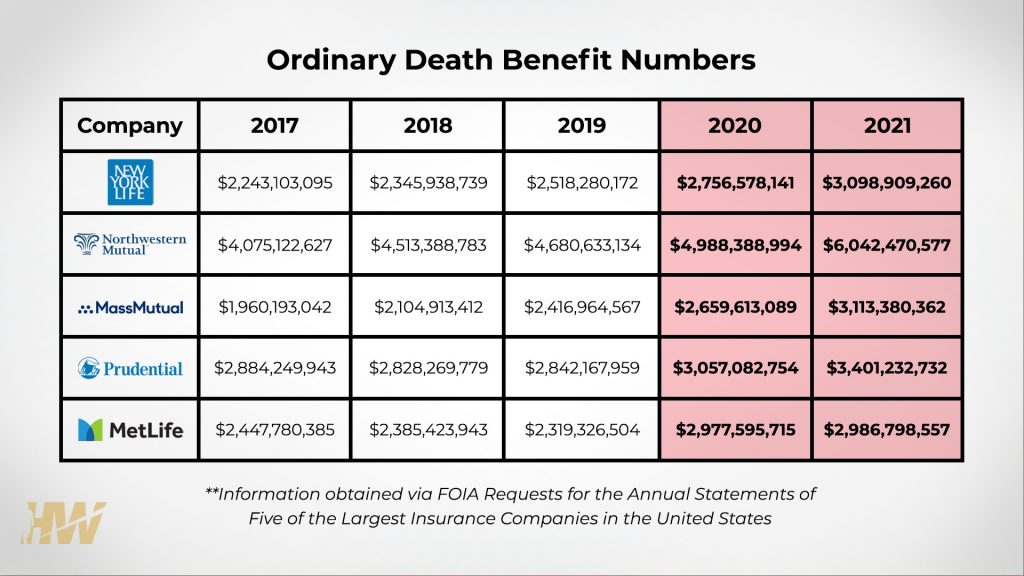

Annual statements from 2017-2021 were obtained from Met Life, New York Life Group, Northwestern Mutual Group, Mass Mutual, and Prudential America Group.

Below is the chart showing Ordinary Death Benefit numbers for each year. The red highlight signifies the years of the COVID pandemic response.

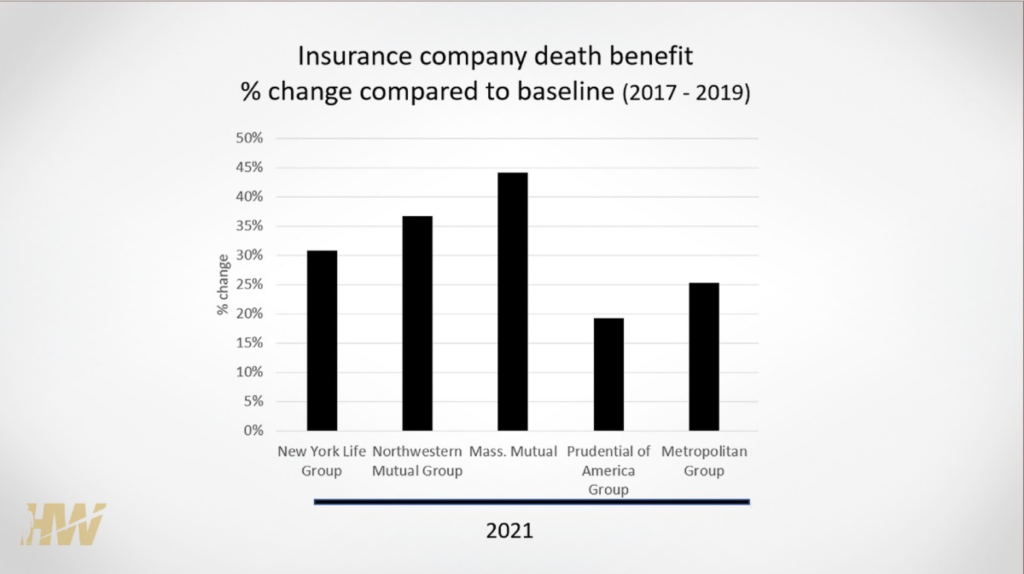

Looking at the data as a percentage and comparing the pre-pandemic baseline years of 2017-2019, numbers begin to approach those described by OneAmerica CEO Scott Davison. Mass Mutual, Northwestern Mutual Group and New York Life Group lead the pack all showing over 30% increase in Ordinary Death Benefit payouts compared to the pre-pandemic baseline years of 2017-2019. All five groups show increases of varying rates.